GZV #49: Snapchat to $115.

Welcome to this weeks edition of GZV. Very excited to be halfway through summer, mostly because the concerts I’m going to are just around the corner. Anyways Happy 4th!

Before we get to the startup, I highly encourage all founders and all VC’s who know founders to check out Hoodle’s 8th fundraising camp.

The founders of Hoodle, Jack and Dan, are close friends of mine and raised a highly competitive $3 million seed round from some of the top investors in the world.

This camp is just 3, 1 hour sessions over 1 week and free, all you have to do is apply. Check it out.

Fyi, they did not pay me to post this, I am just a big fan of what they are doing.

Now this one is interesting… check out Atmos.

Problem:

Homebuying isn’t personalize. Well, that is unless you decide to do some major renovations to your house.

Solution:

Atmos allows you to buy, build, and design your home all online.

Gen Z *and millennial* View:

*Gen Z isn’t exactly buying homes, so I am doing my best to predict the future.

I foresee a personalization factor really hitting home with Gen Z, we love to make things our own and a house could really use an uptick in the personalization factor.

Atmos not only makes it easy to design a house, but it makes it super easy to buy as well. This makes the task way more comforting and trusting to younger generations.

Finally, it’s all in the hands of Atmos, once you buy and design your house, they manage it all.

Quick notes:

Currently building in North Carolina, an very high opportunity area in housing from my view of living there for 3 years.

CEO is a 3x founder and company is YC alum

Website:

My short, not so technical Snapchat Pitch

This won’t be a usual stock pitch, I don't trade that way. I view every stock very fundamentally and only usually invest in companies I know and love. Every stock has a certain value in my mind that the price should be at. For example, Peloton in my mind is $175, Apple is $130, AirBnB is $165, etc. And yes I have positions in all these stocks.

So here is the reason I am investing in Snapchat; it’s just two slides.

I love two things when I look at companies, one being a solid innovation record, and the second being room for improvement on the revenue side. Snapchat has both, and better yet, they could mix them together.

In the startup world, we know that innovation wins. Tiktok is a great example of how a major innovation can lead to a multi-billion dollar company. Problem is when companies go public they tend to lose their innovative touch, Facebook being a prime example. Snapchat hasn’t lost theirs and that is why I love the first slide. Even if some of these innovations are missing their mark, Snapchat still has the drive.

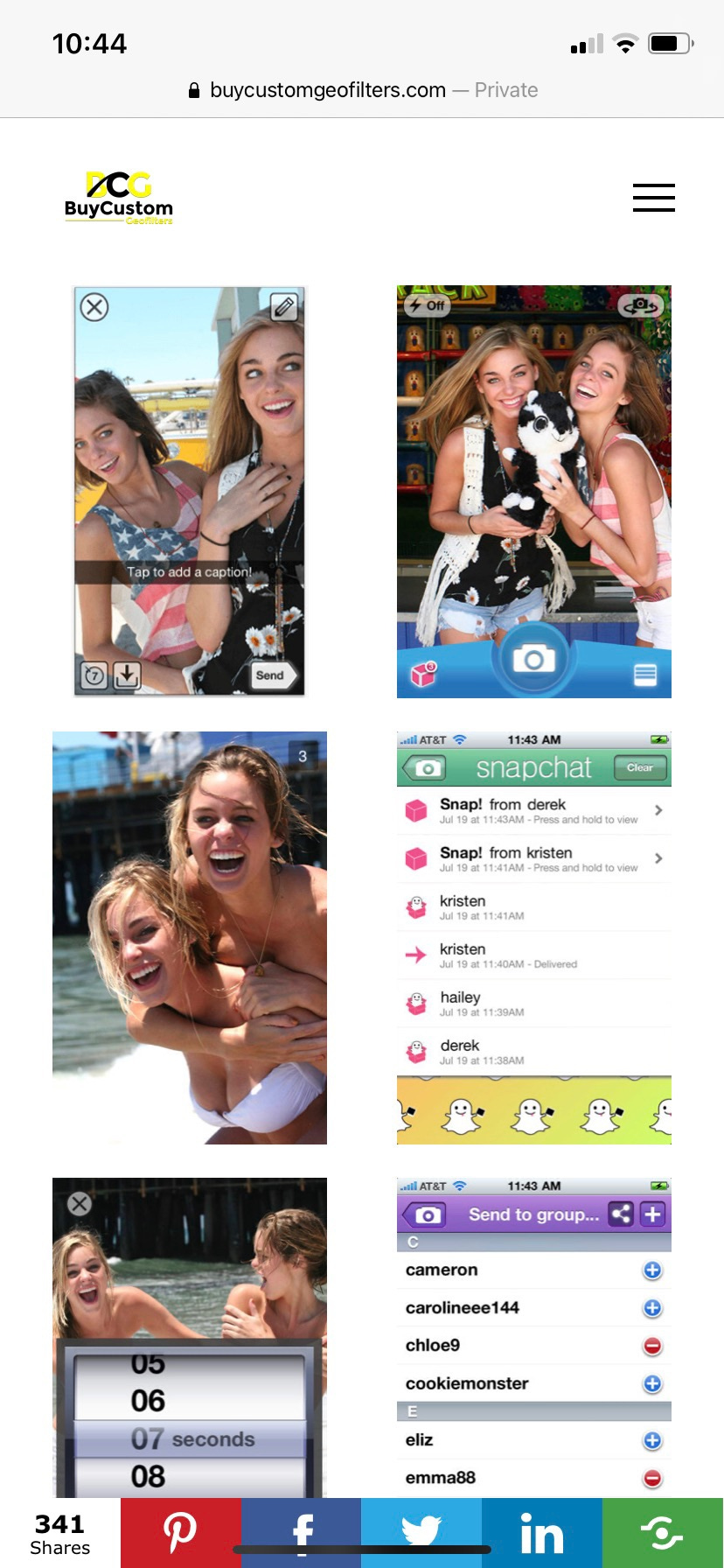

My friend brought up the point though that we (my friend group) have barely used any of these innovations. I agree with that, but it comes from a veteran snapchat perspective. See, when we got on Snapchat it looked like this…

The company has come a long way since my friends and I started using it, making the point that we have used a pretty fair amount of Snapchat’s innovations over the years. So for some 15 year old who is getting on the platform this year, their starting point looks a lot different than ours was. This allows for the younger generations to capture Snapchat’s newest features and innovations whereas kids my age and up (21), would not be as experimental.

And this correlates directly to the second slide, Snapchat’s ARPU opportunity. With a consistent drive to innovate and a growing user base, Snapchat has a large opportunity to grow their APRU dramatically. Now, I have no solid evidence that this will go up, I believe that it will because I believe in the team at Snapchat and I believe in their drive to improve their product on all fronts.

In my mind, Snapchat is a $115 stock in a years time.

*Not financial advice, opinions here do not reflect those of my employers. I am currently long shares of Snapchat in my personal portfolio.

Cheers!

-Tom